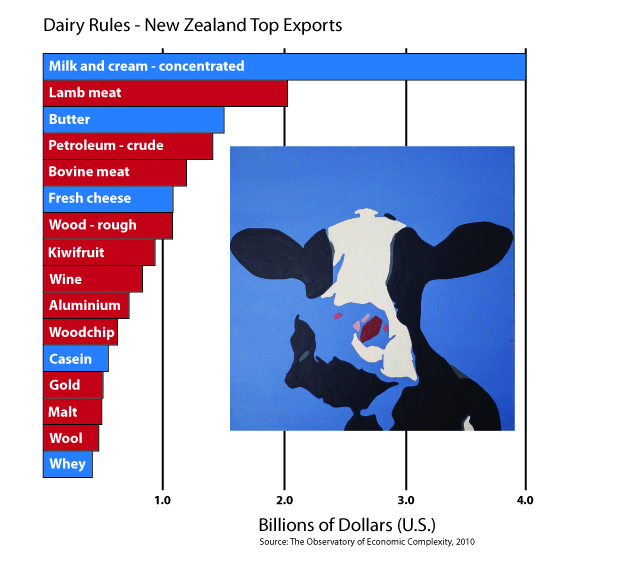

The recent brouhaha regarding the possible contamination of Fonterra milk products has again raised concerns about the lack of diversity in the New Zealand economy. While it is generally acknowledged that primary production underwrites our export economy, it can be surprising to see the full extent of this domination.

The Guardian Weekly recently queried the durability of the Australian economy because natural resource extraction is so dominant (60% of exports). They argue that the economy has been hollowed out by a resources boom which has driven up the exchange rate making all other exports deeply uncompetitive. Although New Zealand is pretty much in the same boat vis a vis the primary sector, we remain lucky that the demand for primary produce – particularly out of Asia remains strong. But as has been high-lighted by the the dairy scare, this economy is particularly vulnerable to contamination, imported pathogens and invasive pests e.g. varroa mite and PSA.

This relatively limited diversity and complexity of exports from New Zealand influences both the potential of the economy to grow and its resilience. The Economic Complexity Index is an attempt to measure these factors and places New Zealand between Tunisia and Costa Rica at 48th in an analysis of 128 countries . Unsurprisingly in this ranking Japan and Germany head the list, but perhaps echoing the Guardian’s concerns, Australia sits way down in 78th place.

Dairy is likely to consolidate its dominant position in the New Zealand export economy with the OECD predicting dairy conversions to continue through to 2020 with production increasing 2.3% per annum. More than a million dairy cattle have been added to the herd since 2007 (up 23%) at the expense of sheep (down 18.7%), beef cattle (down 15%), deer (down 24%) and pigs (down 14%). There has also been a trend for consolidation of herds with a tripling in average dairy herd size to nearly 400, coincident with a 25% reduction in the number of herds since 1980.

This continuing concentration of exports derived from dairy production further exacerbates the risk to the economy and perhaps explains the fervour of the minority National Government for mineral exploration. Our fourth largest export earner comes from a handful of small oil and gas fields in Taranaki and most of our gold comes from two mines. Thus a mineral discovery or two could significantly improve the bottom line and help diversify the economy.

The $30M the government gave to Rio Tinto to keep their aluminium smelter open for a few more years wasn’t just to bolster the imminent public sale of our largest power producer, but also acts in the short term to maintain our #10 export earner.